Signing Agent tip: How to make more than $50 per loan signing

One of the greatest challenges Notary Signing Agents face is finding a way to make more than a $50 fee per loan signing appointment.

The simplest way to get higher fees is to go directly to the title officer, escrow officer or other mortgage professional. When you do this, you get to keep 100% of the fee (instead of splitting it with the signing service).

Here are 3 simple steps for bypassing the signing service and going directly to the mortgage professional:

- Step 1: Understand Who Works for Who

- Step 2: Know What to Say

- Step 3: Meet and Repeat

Here’s what you need to know.

Signing services vs. mortgage professionals

Signing services can be helpful, especially when you first start your NSA career. The benefit of getting loan signing jobs from signing services is they do the marketing for you, so you simply have to accept the assignment when you receive a text message. It’s the easiest way to get loan signing jobs.

However, one of the biggest mistakes you can make as a Notary Signing Agent is to only get your loan signing assignments from signing services.

Because signing services act as a middleman between you and mortgage professionals, the signing service takes a portion of the fee and gives you the remaining portion. So you will get a much lower fee than stated in the closing documents.

By getting loan signing assignments directly from the escrow officer, title officer, or other real estate professional to get your loan signings directly from the source. And you get the entire fee.

By going directly to the mortgage professionals, you will be able to increase your fees by 25 percent to 100 percent.

How to get direct loan signing assignments in 3 simple steps

So now the question becomes, how do you get direct loan signing assignments? I teach my students three simple steps to getting loan signing assignments.

Step 1: Understand who works for who

Most NSAs think that the best way to get loan signing jobs directly is to approach the escrow or title officer. However, there is a better way. The key is knowing who works for who in the real estate industry.

While escrow officers have the ability to give you loan signing jobs, they court another real estate professional to get more business: the real estate agent.

For this reason, escrow officers will listen to the real estate agent’s recommendations when it comes to selecting an NSA. In other words, the agent can ‘force’ a signing.

This is good news for you because we all know a real estate agent or know someone who knows a real estate agent.

Step 2: Know what to say

Once you find a real estate agent to approach, you simply need to know what to say to them for them to want to select you as their Notary Signing Agent for their next home closing.

The key to approaching mortgage professionals for more loan signing jobs is simple: Focus on their needs, not yours.

Simply explain how you can help them provide a better experience for their clients. Talk about how detail oriented you are so there won’t be any delays in closing, and discuss a few more key points that can help their business grow. Do this and you will find success in approaching them for direct closings.

Step 3: Meet and repeat

Every good marketing effort relies on repetition, so simply apply the law of numbers by meeting with as many real estate professionals as you can and repeat your script to help them with their business. And then follow up with them.

Breaking the escrow officer myth

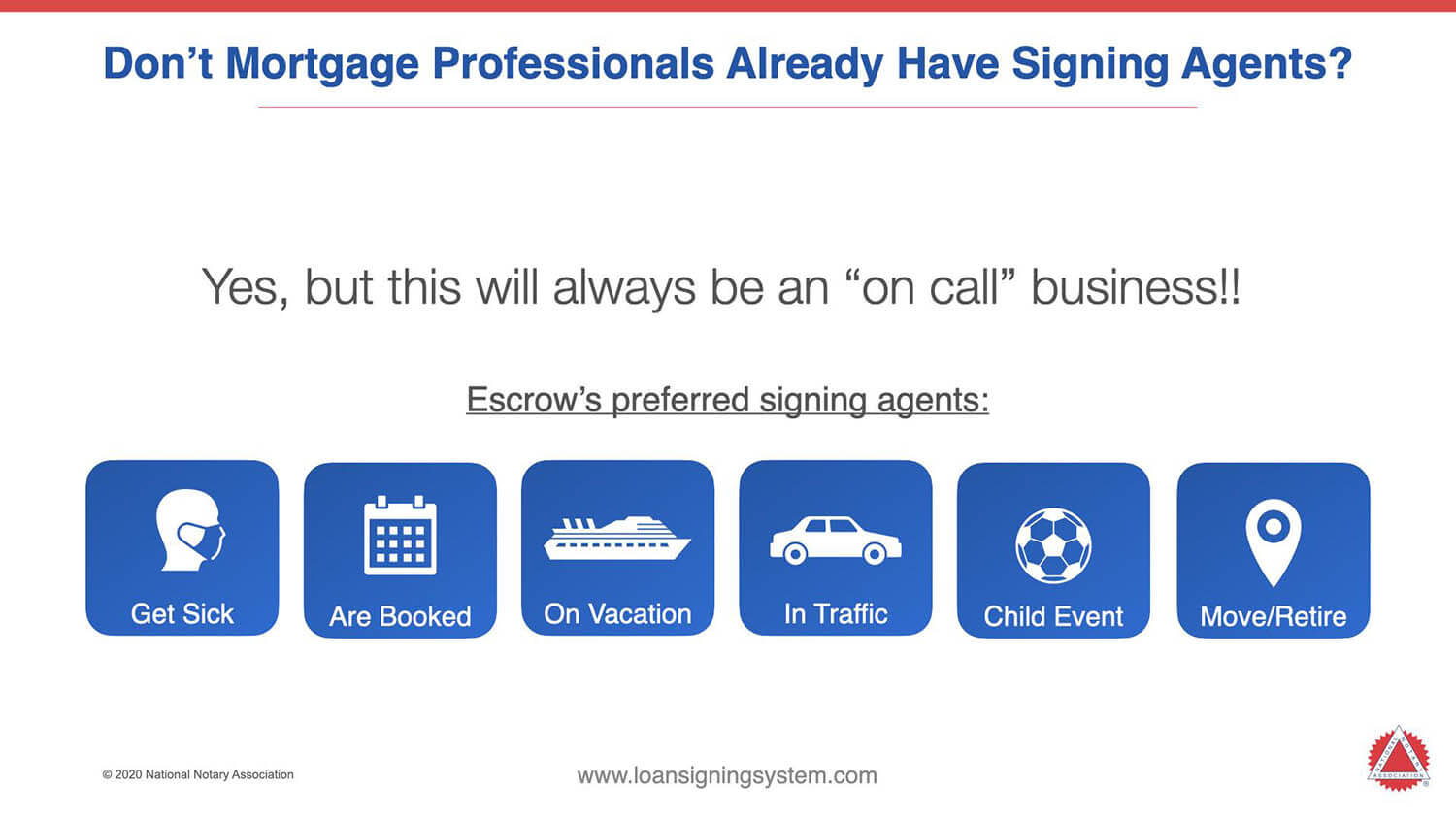

Many NSAs think it’s nearly impossible to get signings directly from mortgage professionals because they already have a group of Signing Agents they work with. That’s one of the biggest myths in the loan signing industry.

In fact, nearly 70% of my students are getting at least some of their direct signing jobs after having more than one year of experience.

Escrow officers usually work with 5 to 10 NSAs at a minimum because the Signing Agent industry is an ‘on-call’ business. Meaning signing appointments come in at various times throughout the day. So the NSAs an escrow officer works with may not always be available, and having some back-up notaries are always helpful.

Mark Wills of Loan Signing System is a Notary educator, a mentor to more than 4,000 Notary Signing Agents and a Forbes Real Estate Council Member. For more information on how to market your loan signing agent business, please go to loansigningsystem.com.

Comments

Post a Comment